TurboTax ® is a registered trademark of Intuit, Inc. PENALTYucator: late filing and late payment penalty estimator, calculator.

Last day to due taxes 2019 how to#

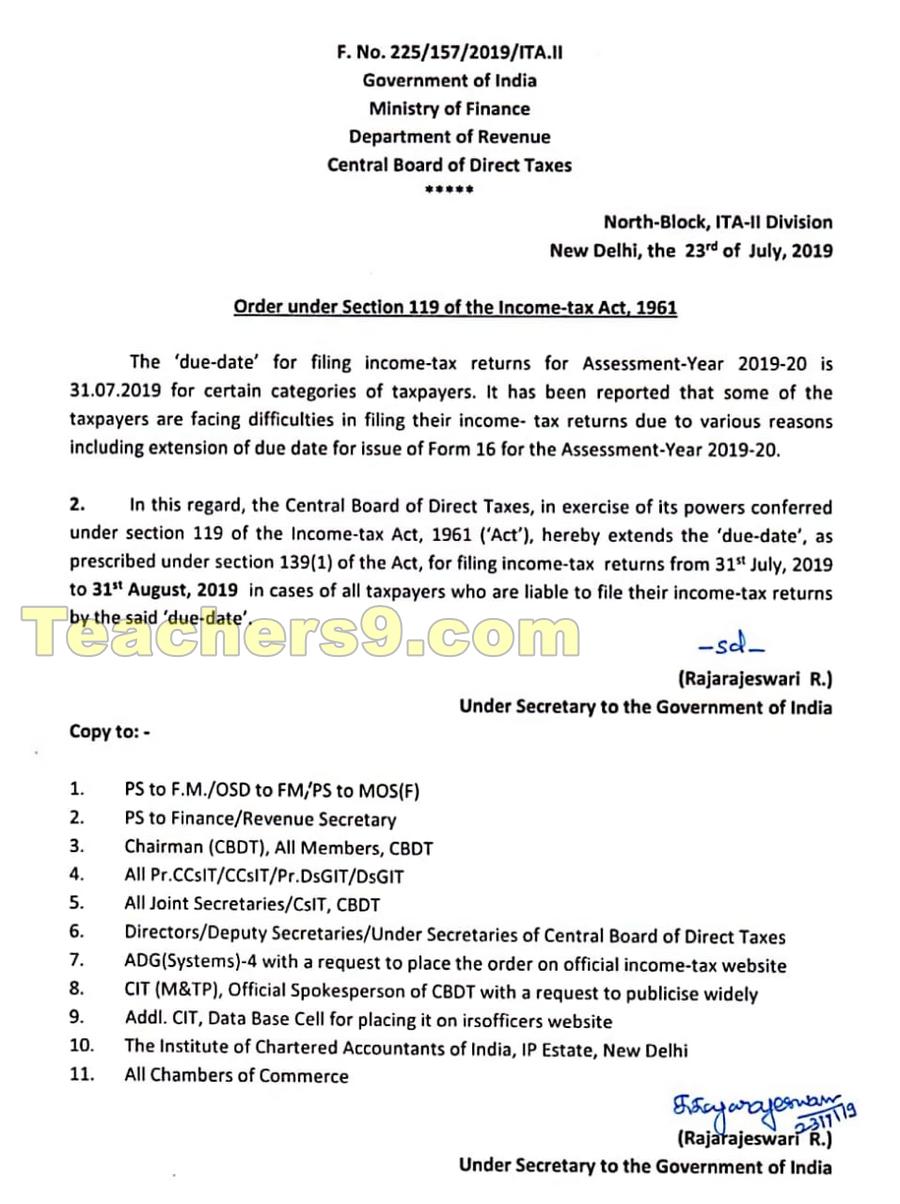

If you are owed a tax refund and you do not file by April 15, you can still e-file your taxes until October 15 and face no penalty if you are in fact owed a refund. What happens if you miss the April 15 deadline and you are owed a refund? What happens when you do not file your taxes by April 15? Can you file late taxes online? What are the penalties for filing late? Can the IRS take your refund for filing late? Below, find the two separate scenarios to navigate to based on whether you owe taxes or if the IRS owes you a tax refund. What to Do if You Miss the April Tax Day Deadline Dare to Compare to TurboTax ® or H&R Block ®! If you miss the e-file deadline - usually October 15 following a tax year - you will have to prepare back taxes.

Last day to due taxes 2019 free#

Keep track of the above dates and sign up for a free account to get your federal and applicable state tax returns e-filed on time each year. Let work for you! Since tax returns can only be filed electronically for the current year as per IRS and state regulation, is updated each season to allow individuals to prepare and e-file their present year returns. Visit your state page for details.įile your current year return online each year so you do not have to handle complicated tax forms and do all the work yourself. Complete, sign, download, and mail in the forms only as the e-file option has expired for back taxes.

A tax return will still need to be filed for any business reporting, even if the taxable wages are less than $85,000 and tax due is $0.File as soon as possible. These changes are effective Jand expire June 30, 2015. July 11 (Reuters) - A 'special rebalance' of the Nasdaq 100 index (.

For example: if the sum of all wages for the 9/13 quarter is $101,000 after health care deductions, the tax is $187.20 (0.0117 x $16,000 which is the amount exceeding $85,000). 2 days ago &0183 &32 REUTERS/Jeenah Moon/File Photo. If the sum of all the wages paid by the employer exceeds $85,000 for the calendar quarter, the tax is 1.17% of the amount of the wages that exceeds $85,000. If the sum of all taxable wages, after health care deductions, paid by the employer does not exceed $85,000 for the calendar quarter, the amount of tax is 0% of the sum of those wages. Additionally, the Tier 1 threshold is increased from $62,500 to $85,000. The changes under this bill extend the 0% rate on Tier 1 of the MBT to June 30, 2015. SB475 of the 2013 Legislative Session became effective July 1, 2013. The 2011 Legislative Session pursuant to AB 504, reduced the interest rate to 0.75% (or. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses.

0 kommentar(er)

0 kommentar(er)